🎫 Can I Sell Tickets to a Personal Event?

You don't need to be a business or event promoter to sell tickets or collect money for an event! You can use 'ticketing' to collect donations, chip in on the cost of an event or trip together, or to gather gifts for the event honoree.

While Stripe's account creation language is business-centric in some cases, Stripe is equally easy to setup and use for personal or non-profit events.

Regardless of your event type, you will still need to complete the Stripe setup to accept and process payments of any kind.

Tell Us About Your Business

Simply enter in details about your event and why you're collecting payments. If accepting monetary gifts for your wedding, for example, enter something like:

"Accepting monetary gifts from my wedding guests."

If for a non-profit event, or fundraiser, for example:

"We're holding a car wash for the cheerleading squad and selling tickets online."

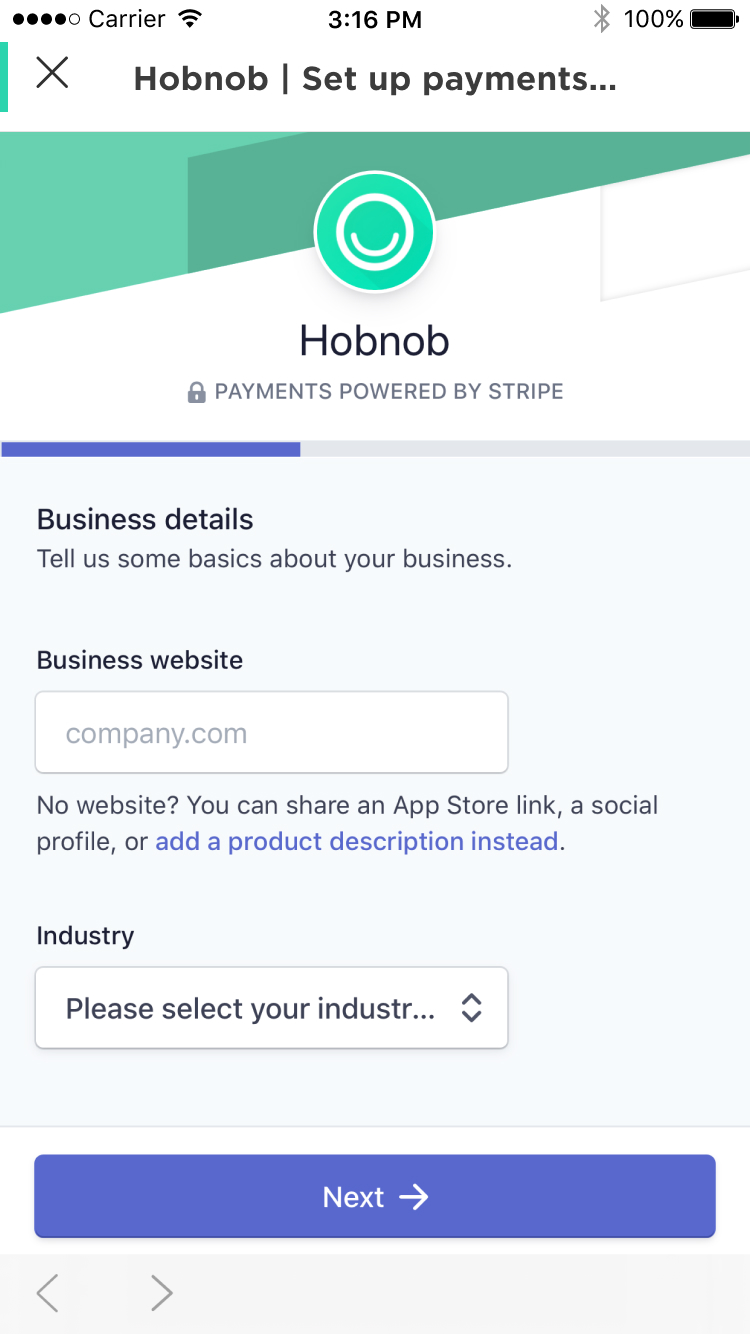

Your Website

Enter any personal, professional or Hobnob event web address.

If your creating an event for a non-profit or organization like a Parent Teacher Organization, enter in the URL of your organization's website.

If you're using Hobnob for a wedding, you can enter the URL of your wedding website or Hobnob event.

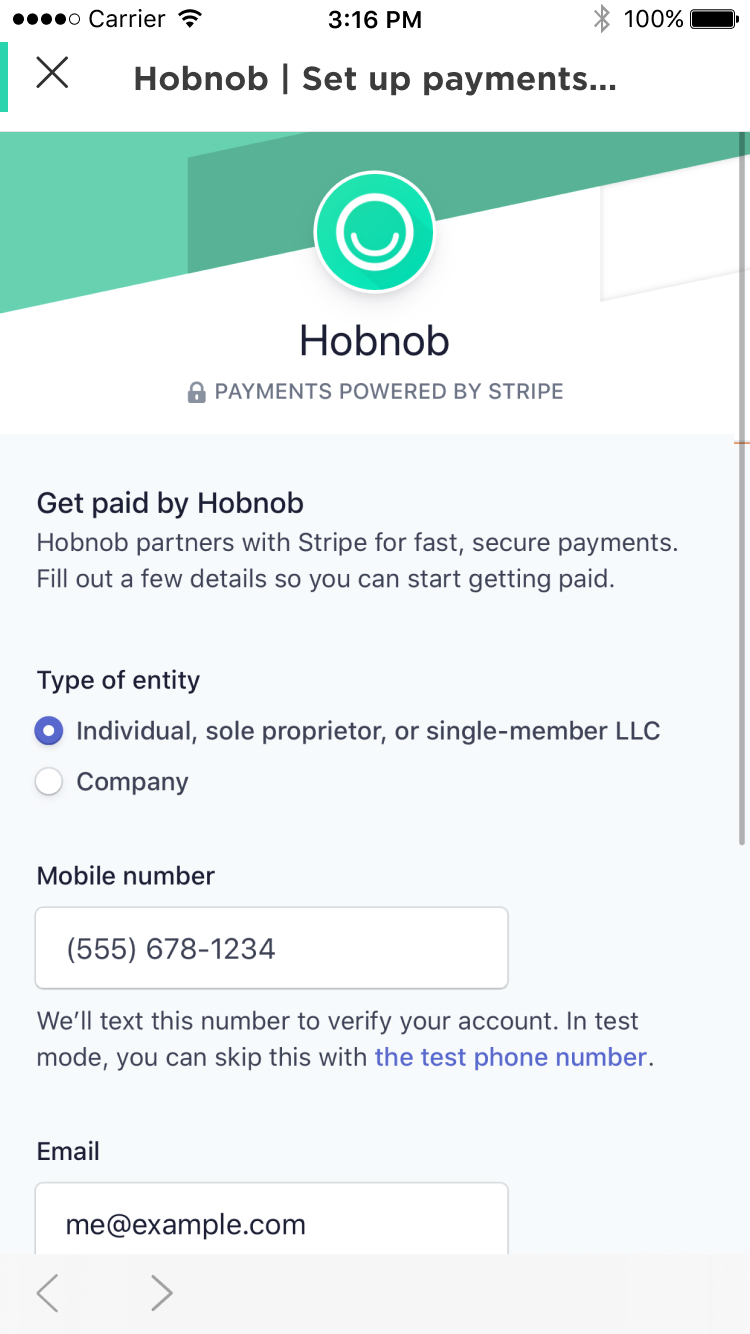

Account Details

If accepting payments personally, select Individual / Sole Proprietorship. Enter the last four digits of your Social Security Number. This is simply to satisfy federal banking regulations and is verified securely through Stripe.

If accepting payments for your non-profit or student organization and you don't have a Tax ID, select Individual / Sole Proprietorship. Enter the last four of a Social Security Number of an organizational board member or executive.

You, the Business Representative

Enter your personal details. If accepting payments for your non-profit or student organization, you must enter the personal details of an authorized board member or organization executive.

Credit Card Statement Details

Make this something that your guests will readily recognize as associated with you or your event. Such as "Cheer Squad Car Wash Fundraiser" or "Joe and Ann's Wedding Gifts"

Are there tax implications to accepting payments or gifts through Stripe?*

While Stripe's setup is indeed (and unfortunately, for private users) business-centric in some cases, Stripe operates just like PayPal and other online payment leaders and is hugely popular among private individuals and small organizations as well as businesses.

While by no means tax advice, and you should consult your tax or accounting professional, the same local and federal laws should apply to payments processed by Hobnob and the Stripe platform as would apply to payments processed by other means.

- A non-taxable gift received offline should also not be taxable if the payment is received online; Monetary gifts received through Stripe should have the same tax implications (in most cases, none) as cash gifts received through other means

- Payments accrued for a private or not-for-profit event that is otherwise non-taxable should also not be taxable if these payments are processed online

(Legally, Stripe does need to ask for a piece of personal information such as SSN or organizational tax ID in case payments processed are taxable and a governmental entity inquires.) In summary, regardless of the online or offline platform used for payment collection, the same tax laws in your country and region should apply. Consult a local tax professional for more information.

*Hobnob is not a tax advisory entity, and the above should not be regarded as tax or legal advice. Hobnob is not responsible or liable for failure to comply with local, state or Federal laws applicable to you or your organization, and you should seek professional advice for your event, organization or use case.

Event tickets are currently only available for hosts using iPhone, Android coming soon!